Currently Auto Renta is available for DeGiro, IBKR, Trading 212, Revolut, eToro and MyInvestor. A generic template is available and can be filled in for unsupported brokers.

Note: It is very important to attach the total movements (the entire history) since the opening of the account with your broker, otherwise the report will be incomplete.

Below are instructions on how to obtain the transaction and dividend history statement. If you want to generate the report for several brokers, it is possible by creating a single ZIP file with all statements.

- DeGiro

- IBKR

- Trading 212

- Revolut

- eToro

- MyInvestor (New 29 May 2024)

- Other Brokers not supported (Valid for clickTrade, ING, HeyTrade, TradeRepublic,..)

DeGiro

Auto Renta generates the profit and loss report from of the full transaction history since the account was opened and dividends. Below are instructions on how to obtain:

Note: If you are attaching both files (Transactions and Dividends), do not forget to attach both files (transactions and dividends) in a single ZIP file.

Once you get the extracts of its full trading and dividend history you can make your purchase process at:

Transactions

Note on AutoFx commission on DeGiro (Automatic currency exchange)

The automatic currency exchange (AutoFx), is a fee charged by DeGiro which is 0.1% for transactions before 20 December 2021 and 0.25% from that date onwards.

This information is not included in the CSV of transactions, so at Autodeclaro, we account for this commission in the Profit and Loss Report.

Note: If you have transferred positions to DeGiro or from DeGiro to another broker, they will be identified as purchases or sales in the statement.

We have been told that in the annual report DeGiro takes transfers to another broker as sales. These operations should be removed if you want them to be ignored.

Contact us if you need assistance in identifying these records.

1/ Go to DeGiro WebTrader

2/ Click on the "Mailboxin the menu on the left and click on " " in the menu on the right.Transactions".

3/ On the transactions page, select the date range containing all your operations.

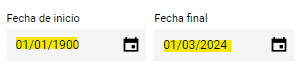

Note: To ensure that all transactions are obtained from the opening of the account start date must be indicated. ’01/01/1900′ and end date ‘1/03/2024’ (ensure compliance two months beyond the end of the year 2023)

4/ Click on the button "Export". on the right-hand side of the screen.

5/ Select "CSV" "CSV" "CSV" "CSV" "CSV" "CSV" to export your operations as a CSV file and save it.

Note: Continue with the extract from Dividends (Statement of account) as it is necessary to determine the AutoFX (automatic currency exchange) commission when it was active on your account.

Note Language of extracts: If your statements are in a language other than English, adjustments must be made to the statement.

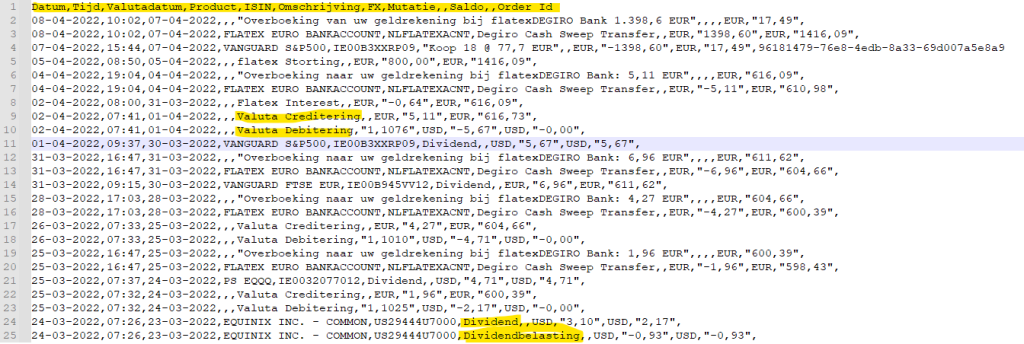

In this example, the header of the CSV extract of transactions is in Dutch:

You would have to open the CSV with Notepad or Notepad++ and remove the header by this one below that you can copy and paste.

Date,Time,Product,ISIN,Exchange,Execution Venue,Number,Price,,Local Value,,Value,,Exchange Rate,,Transaction Costs,,Total,,Order ID

Dividends

Note: Yes has no Dividends and all its transactions are in EUR. (i.e. there are no trades in non-EUR currency), it is most likely that when you place the order, it will indicate an error that it is empty or there are no relevant positions. In this case, you can skip this dividend CSV file and do not include it.

1/ Go to DeGiro WebTrader

2/ Click on the "Mailboxin the menu on the left and click on " " in the menu on the right.Statement of account".

3/ On the 'Statement of account', select records from the ’01/01/1900′' al ’01/03/2024′. The report will show the history of Dividends collected up to the date you specify.

4/ Click on the button "Export". on the right-hand side of the screen.

5/ Select "CSV" "CSV" "CSV" "CSV" "CSV" "CSV" to export your operations as a CSV file and save it.

Note Language of extracts: If your statements are in a different language (English, Italian, Dutch, etc.), you have to make adjustments to the statement by modifying the header by the English texts and also the Dividend and currency exchange concepts.

Dutch:

In this example, the CSV header of the bank statement CSV is in Dutch:

You should open the CSV with Notepad or Notepad++ and remove the header by the English name. You can then copy and paste the following.

Date,Time,Value date,Product,ISIN,Description,Type,Variation,,Balance,,Order ID

In addition, the following texts in the Dutch a English:

- Dividend by Dividend

- Dividendbelastng by Dividend withholding

- Valuta Creditering by Income Foreign Exchange

- Valuta Debitering by Withdrawal Currency Exchange

It would look like this:

English:

In this example, the CSV header of the bank statement CSV is in English:

You should open the CSV with Notepad or Notepad++ and remove the header by the English name. You can then copy and paste the following.

Date,Time,Value date,Product,ISIN,Description,Type,Variation,,Balance,,Order ID

In addition, the following texts in the English a English:

- Dividend Tax by Dividend withholding

- Dividend by Dividend

- FX Credit by Income Foreign Exchange

- FX Debit by Withdrawal Currency Exchange

Interactive Brokers

Auto Renta generates the profit and loss report from the complete transaction history. All transactions for all years since the account was opened must be provided..

For dividends this would not be necessary unless you want your dividend history to be displayed as well.

Below are instructions on how to obtain:

All CSVs shall be grouped in one file. .ZIP which will be used for the purchase process.

Note: It only allows you to export a maximum of one year, i.e. 365 days. If you opened the account before 2021, you will have to export separately several times since you opened the account until today with the option (Customise data range).

Once you have obtained the extracts you can make your purchase process in:

Attention:

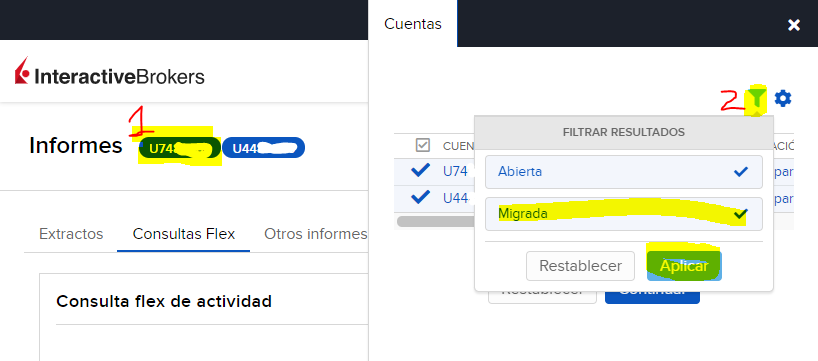

Was your account migrated at the end of 2020 and 2021 due to the UK's exit from the European Union? or

Have you transferred shares between IBKR accounts?

In that case, it is likely that you will not be able to select dates prior to migration or transfer.

To make the migrated account information visible, it must be activated as follows.

1/ Go to your IBKR identifier

2/ This will open the window on the right and go to the "Filter

3/ Activate or tick the option "Migrated". and then go to "Apply"..

Transactions

1/ Enter to Client Portal.

2/ Go to the tab "Performance & Statements (Yields and Statements) -> "Flex Queries.

Click on the "Flex Queries" tab.

3/ In the section "Flex activity consultation".Click on the "+" sign to create a new query.

4/ Fill in the 'Query name' field with whatever you want, for example. "Self-declared operations. Then select the following three sections:

- "Operations

- "Corporate actions

- "Transfers (Note: Select ONLY if you want position transfers to/from another broker to be taken as sales/purchases)

5/ Let's start with "Operations. Click on the "Operations in the section "Sections".

Brand "Select all". and then you unmark the field "Account ID and "Account Aliases and save the options in the "Save". at the bottom of all fields in the table.

6/ Then we continue with "Corporate actions. Click on the "Corporate actions in the section "Sections".

As we did before, mark "Select all". and then you unmark the field "Account ID and "Account Aliases and save the options in the "Save". at the bottom of all fields in the table.

7/ Finally go to "Transfers. Click on the "Transfers in the section "Sections". (Note: Select ONLY if you want position transfers to/from another broker to be taken as sales/purchases)

As we did before, mark "Select all". and then you unmark the field "Account ID and "Account Aliases and save the options in the "Save". at the bottom of all fields in the table.

8/ We leave the default settings and click on the button of "Continue" at the bottom of the page.

9/ In the next screen, click on the button "Create". button on the next page and then "Accept"..

10/ Now, click on the right arrow to run the query and export it in "CSV" "CSV" "CSV" "CSV" "CSV" "CSV".

11/ Select the period you want, e.g. last 365 calendar days, and click on "Execute". to export transactions.

Note: Select operations (remember that it only allows 365 calendar days) from the start of account opening until 1 March 2024 to ensure correct calculation of the two-month rule.

To make it easy you can indicate in each download: del:

- 2024-01-01 to 2024-03-01

- 2023-01-01 to 2023-12-31

- 2022-01-01 to 2022-12-31

- 2021-01-01 to 2021-12-31

- 2020-01-01 to 2020-12-31…

- and so on.

Notes: Note that date ranges (Start date and To date) must be entered starting with the end date (field To date) instead of the start (Start date), by mistake, does not warn you and creates a file with only one date.

Note: the dates of the catches are not up to date.

Dividends

Note 17 May 2024: As some clients have reported to us that the dividend "Flex Queries" query is not getting all dividends (Unilever, Iberdrola for now), we will use the "Dividend report which we detail below how to obtain it.

However, CSVs from the flex query that was used until now will also be valid, but not both types will be attached.

DIVIDEND REPORT - Use this report, new from 17 May 2024

1/ Enter to Client Portal.

2/ Go to the tab "Performance & Statements (Performance and Reporting) -> "Tax Documents (Tax documents).

3/ In the section "Taxesselect the year you want to download the "Dividend report in format CSV.

4/ Once downloaded it will have the name: UXXXXXXXXX.2023.dividends.csv . Remove the identifier code and VERY IMPORTANT put the year at the end of the file.

It would remain: “nameany_2023.csv".

Note: If you wish, you can download previous years to get the dividend report for previous years together with the dividend list once you place your order.

5/ You can also remove personal data from the CSV file for privacy but it will not be used by Autodeclaro for any purpose.

Open with file editors such as "Notepad" or "Notepad++" on Windows or "TexEdit" on Mac (DO NOT OPEN WITH EXCEL) and go to line 2.

The result would be to leave line 2 (important to leave commas): Account,Data,,,,EUR,

FLEX CONSULTATION - See note of 17 March 2024 above

1/ Enter to Client Portal.

2/ Go to the tab "Performance & Statements (Yields and Statements) -> "Flex Queries.

Click on the "Flex Queries" tab.

3/ In the section "Flex activity consultation".Click on the "+" sign to create a new query.

4/ Fill in the 'Query name' field with whatever you want, for example. "Self-declared Dividends". and click on the "Change in accrued dividends". in the section "Sections".

5/ Brand "Select all". and then you unmark the field "Account ID and "Account Aliases and save the options in the "Save". at the bottom of all fields in the table.

6/ We leave the default settings and click on the button of "Continue" at the bottom of the page.

7/ In the next screen, click on the button "Create". button on the next page and then "Accept"..

8/ Now, click on the right arrow to run the query and export it in "CSV" "CSV" "CSV" "CSV" "CSV" "CSV".

9/ Select the period of the 2 January 2023 (first school day) at 31 December 2023and click on "Execute". to export dividend information.

Note: If you add dividend information from previous years, there is no problem; the report will be broken down by year. In this case you would have to export in IB for each year as it does not allow more than 365 days per CSV extract.

Trading 212

Auto Renta generates the profit and loss report from the complete transaction history since the account was opened together with the dividends.

Below are the instructions on how to obtain trades and dividends from the Trading 212 broker (all in one file):

Note: Trading 212 only allows you to export 365 days, if your account is more than one year old download all years and compress all files into a single ZIP file.

Once you have obtained the extracts you can make your purchase process in:

Revolut

Auto Renta generates the profit and loss report from the complete transaction history since the account was opened together with the dividends.

Below are the instructions on how to obtain the transactions and dividends from the Revolut broker (all in one file):

1/ Login to the Revolut website: https://app.revolut.com or directly download the extracts at https://app.revolut.com/wealth/stocks/statements (Note: 18 June 2024The web option no longer shows the investments, you have to go directly to the app).

Note: If you could not on the desktop web version, open the Revolut app of the mobile phone.

2/ Go to the section on "Invest.

3/ go to Invest", "... More", "... More" and choose "Documents.

4/ Go to "Account statement

5/ Select "Excel" You can set the start date since you opened your account and the end date of your choice, at the latest February of the following year of the year you are making the income tax return. And click on "Get Statement.

You will need to obtain a file in CSV format. Do not open the file with excel, or save it in that format, you could make a copy of it if you want to open and view the contents with excel.

If you open it with Notepad, you can see that it will have a similar structure to this one:

Once you get the extract "Account statement Revolut in CSV format, as indicated in the steps above, you can continue with your Revolut purchase process. Auto-Renta en:

eToro

Auto Renta generates the profit and loss report from the 2023 transaction statement together with the dividends.

Note: We have detected that the profit indicated by eToro on the "Closed positions". is not the same (it is less) than that calculated by Autodeclaro. We understand that there is some hidden commission, but it is not detailed either. With the "Dividends"no problem.

Below are instructions on how to obtain trades and dividends from the eToro broker. Everything comes in a single Excel file that you download from the eToro platform, but two CSVs will have to be created from that Excel who are those who we will contribute to Autodeclaro:

- Step 1: Download eToro Excel extract

- Step 2: Generate the 2 CSV files (closed trades and dividends) from eToro's Excel file.

STEP 1

1/ To get the extract in Excel format, you have to go to "https://etoro.com/porfolio"and then go to the section on "Settings".

2/ Then go to "Account

3/ And on the next screen you can go to "Account Statement

4/ Indicate below the Last year (previous year in our case 2023). And click on "Create:

We then continue with the STEP 2to create the CSV of the dividends. We are going to do it with Google Sheets instead of Excel, the reason is that depending on the version of Excel or languages, it does not respect the separation of ',' in the resulting CSV file and uses another separator such as ';'.

STEP 2

1/ Go to Google DriveOnce there, we will upload the Excel file that we have previously downloaded from eToro.

Important: Check that the quantities do not contain two decimal separators.

There is a button "+ New" or "+ New" (depending on the language), select the eToro excel and it will be uploaded to your Google Drive space.

And open the excel previously downloaded from eToro,

2/ We will need to download in CSV the tabs "Closed positions". and "Dividends.

OBTAIN THE STATEMENT OF TRANSACTIONS

3/ Go to the tab "Closed positions". and change the text of "Acción" by "Acciorn" (delete accent).

Note: If we have the header in another language, we have to change it to Spanish, in this case the fields would look like this, without accents:

Position ID,Stock,Amount,Units,Opening Date,Closing Date,Leverage,Spread Commissions (USD),Spread Spread (USD),Profit (USD),Profit (EUR),Opening Rate,Closing Rate,Take Profit Rate,Stop Loss Rate,Rollover and Dividend Commissions,Copy From,Type,ISIN,Notes

Note: check the country indicated in Google Sheets. For them go to "Archive -> "Configuration" and mark the "regional configuration". in Spain, that way we will have the decimal separator as ',' and the thousands separator with the '.'.

4/ In the same tab "Closed positions". to download the CSV. Go to "File" -> "Download" -> "comma separated values (.csv)".

5/ The .CSV file (comma separated) will be downloaded to our "Downloads" folder.

OBTAIN THE DIVIDEND STATEMENT

5/ Repeat the same steps as in step 4 but this time in the "Dividends,

6/ Remove the accents from the fields indicated in the following screenshot

Note: If we have the header in another language, we have to change it to Spanish, in this case the fields would look like this, without accents:

Payment date,Instrument name,Net dividend received (USD),Net dividend received (EUR),Withholding tax rate (%),Withholding tax amount (USD),Withholding tax amount (EUR),Position ID,Type,ISIN

Once you have obtained the two files (closed positions and dividends) in CSV format, create a ZIP file with all the statements and you can carry out your Auto-Income purchase process at:

MyInvestor

MyInvestor has been integrated into Autodeclaro since 29 May 2024.

To obtain the list of Transactions and dividends, please follow the steps below:

1/ Visit the website of Inversis (www.inversis.com/cbmyinvestor).

2/ Go to Client Access to log in with your MyInvestor username/ID and password.

Note: If it doesn't work with the DNI, use your username.

3/ Once inside. Pull down the menu of "INVESTMENTS -> "Funds" -> "Operations and consultations -> "Consultation of operations"..

Note: By choosing Funds, then in the next filter you will have to indicate Product Type" -> "All" -> "AllThis way you will get Dividends, Buy/Sell shares, Funds, etc.

4/ In the operations filter, indicate the fields "Date From" and "Date To"and, in addition, the "Product Type" indicate the value All. In this way we ensure that all transaction history, dividends, funds, etc. come to us.

An Excel file will be downloaded with all movements of shares, funds and dividends.

5/ Go to Google DriveOnce there, we will upload the Excel file that we have previously downloaded from Myinvestor.

Important: Check that the quantities do not contain two decimal separators.

Note: check the country indicated in Google Sheets. For them go to "Archive -> "Configuration" and mark the "regional configuration". in UK, that way we will have the decimal separator as '.' just like the Myinvestor extract.

Note: If you have problems with thousands and decimals when uploading to Google Drive. You can copy the information from Excel to your Google Spreadsheet.

The result is the following header (without accents in the second field) "Operation"and field "Titulos/NOMINAL") and in a single row)

| Date | Clearance | Operation | Market | Operation | ISIN | Value | Titles/NOMINAL | Currency | Net Price | Net amount |

As the following example:

6/ Once we have all the movements and dividends in that Google spreadsheet, we can download the CSV separated by commas.

The downloaded CSV can be used to make the auto-income request to generate the profit and loss report from the statement of transactions and dividends.

Don't forget to ZIP all the statements you may have from various brokers when you make your Auto-Rent purchase process at:

Other brokers not supported

Auto Renta generates the profit and loss report from the 2023 trading statement together with the previously supported brokers' dividends.

However, in order to support other brokers, a template is provided in Google Spreadsheets (Google excel) for the client to fill in if their broker is not supported.

Transactions

The instructions for completing the transactions are shown below.

1/ The excel template is available at "Excel Template"and then make a copy of it in your Google Drive space.

2/ Once copied, you can modify the template in your Google Drive space.

3/ An example may be helpful in completing your transactions.

4/ Please fill in the template:

- Follow the same format in the fields Date DD/MM/YYYYY and Time HH:MM:SS (Columns A and B).

- The shopping have the number of shares (Field I) positive y Total Quantity (Field K) in negative.

- The sales have the number of shares (Field I) in negative y Total Quantity (Field K) positive.

- The exchange rate is not compulsory (Column N), if not indicated, the European Central Bank exchange rate shall be taken.

- If you do not know the ISIN (Field F), complete only the Ticker field (Field H).

Note: Try filling in a few lines and continue to the next point to test the Demo version of Auto-Renta. So you can check that it works.

5/ Once you have completed your template, download it in CSV format.

7/ Once you have downloaded the CSV you can proceed with your Auto-Renta purchase process at:

Dividends

The instructions for completing the dividends are shown below.

1/ The excel template is available at "Excel Template"and then make a copy of it in your Google Drive space.

2/ Please fill in the appropriate fields.

- ISIN: If you do not know it, you can use the ticker.

- Country: If indicated, it is taken into account, otherwise Autodeclaro calculates the country from the ISIN.

- Gross Dividend: Gross dividend in the currency indicated

- Tax/withholding tax: Indicate the tax or withholding tax applied in the currency you indicate

- Destination tax/withholding tax: Indicate the tax or withholding tax at destination (This only applies to brokers based in Spain, ING, Myinvestor, HeyTrade, CaixaBank, Bankinter, clicktrade, etc.).

3/ Once you have finished filling in your template, you can download the CSV at "Archive -> "Download". -> "Comma separated values (.csv)"..

Once you have downloaded the CSV of dividends you can make your Auto-Renta purchase process at:

© 2024 AUTODECLARO.ES - All rights reservedDOS

SOFTWARE DEVELOPED IN SPAIN