Instructions Model 721

Note: Autodeclaro is not a consultancy, nor are we tax experts. We simply automate the completion of Form 721 on the basis of the statements you provide from your exchange.

We are not responsible for your use of the information described here. It is your responsibility to check the information or instructions given here with a tax advisor.

You are ultimately and solely responsible for your declaration.

Once we have received our completed Form 721, the next step is to import the file generated in the tax office.

If you don't have it yet, you can generate it at:

The table of contents of this article is:

Importing and filing with the Tax Agency - Instructions for form 720

Tax Agency

Provincial Council of Gipuzkoa

Provincial Council of Bizkaia

Provincial Council of Alava

Treasury of Navarre

Tax Agency

Note: To display the content of the XML, go to step 8 . Where if you open the excel application you can view the XML file that you have generated in Autodeclaro.

1. Prepare XML file with your personal data, NIF/NIE/DNI and NAME AND SURNAME.

Open the XML file with 'notepad' (Windows) or 'Text-edit' on Mac.

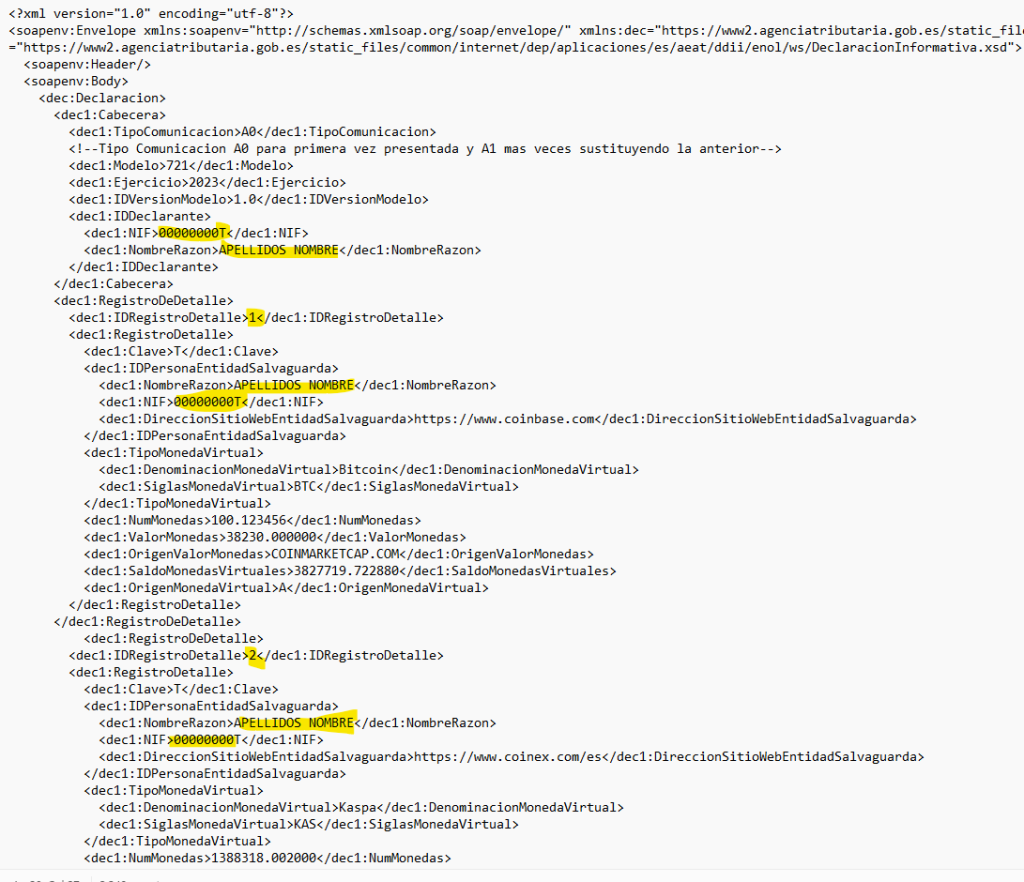

We know you don't have to understand the file, but we show you that the following example has a header and 2 records (DetailRecord 1 and 2).

The following generic information would need to be replaced with your data as follows:

- 00000000T: by their NIE/NIF/DNI EJ. 45682029M (INCLUDE leading zeros if necessary up to 9 characters/positions)

- SURNAME FIRST NAME By surname and first name e.g. LOPEZ MARTIN, ALBERTO.

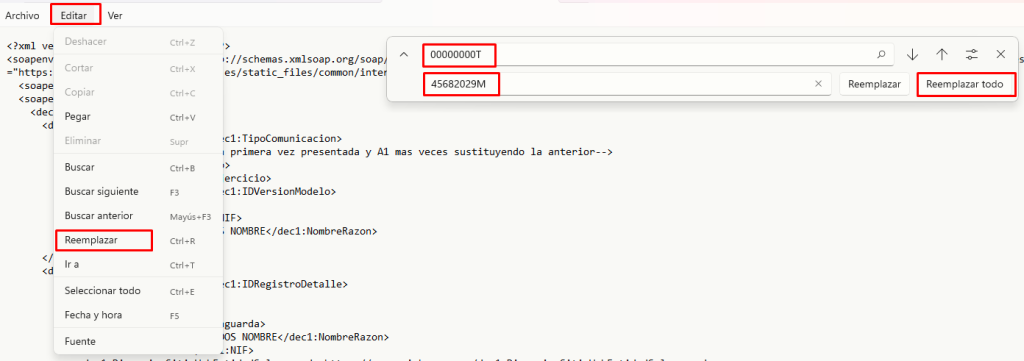

Go to "Edit" -> "Replace". Indicate the values to search for and replace, and click on "Replace all".

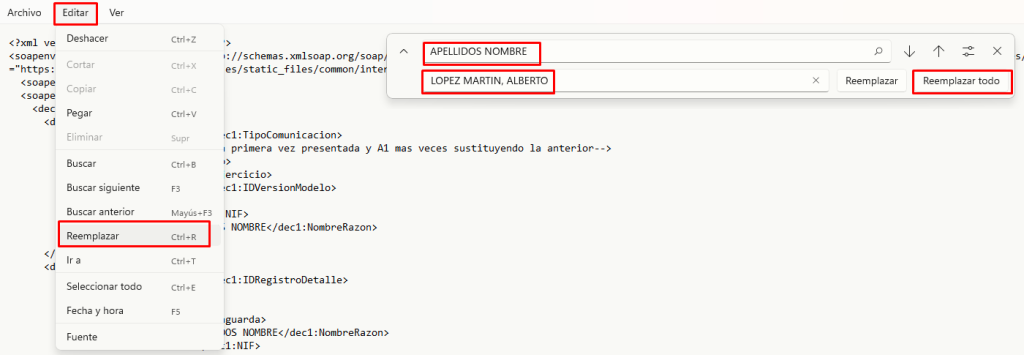

We continue with the change of SURNAME FIRST NAME.

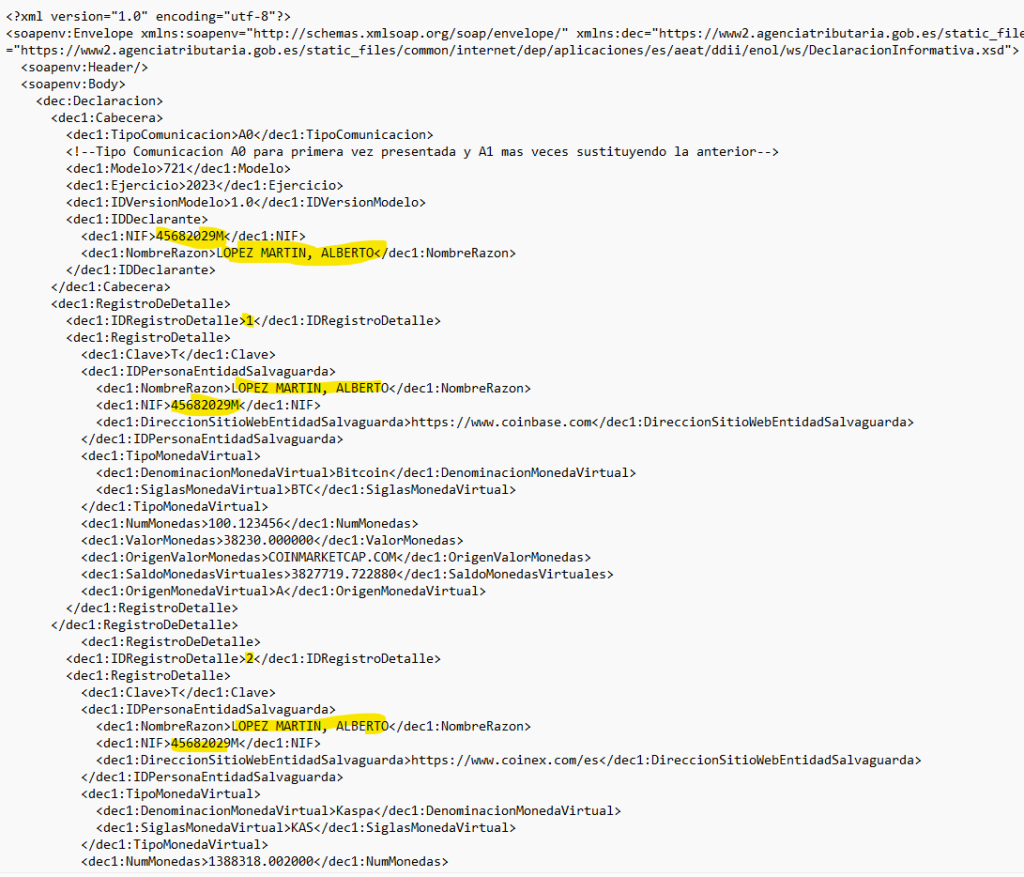

Once these two actions have been carried out, SAVE THE CHANGES in the "File -> Save" menu of the notepad. The result will look like the one shown below:

Note: if we have more records with virtual currencies, when performing the "Replace all" action, the NIF and SURNAME FIRST NAME will be changed to all of them.

We would have the XML file ready, finally SAVE THE CHANGES "File -> Save".

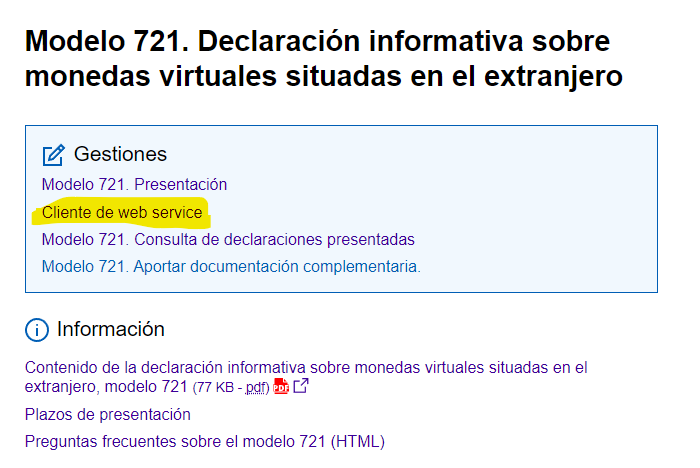

2. Go to the website of the Tax Agency of Form 721.

Note: It is only possible to file using a digital certificate. There is no possibility to use KEY as authentication method.

2. Go to "Web service client (it will ask you to select your electronic certificate) and

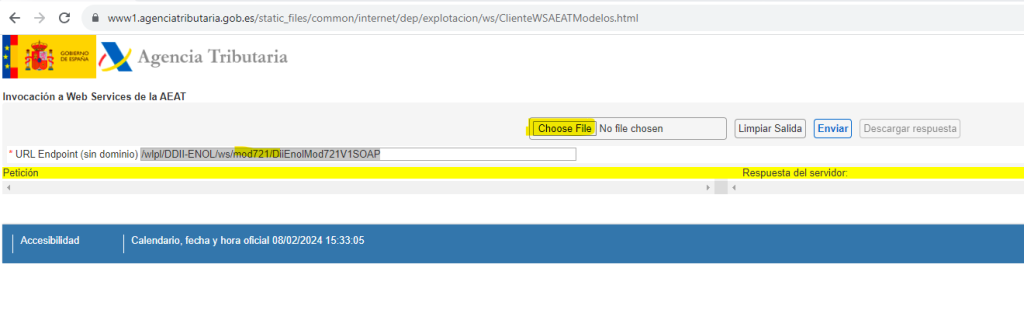

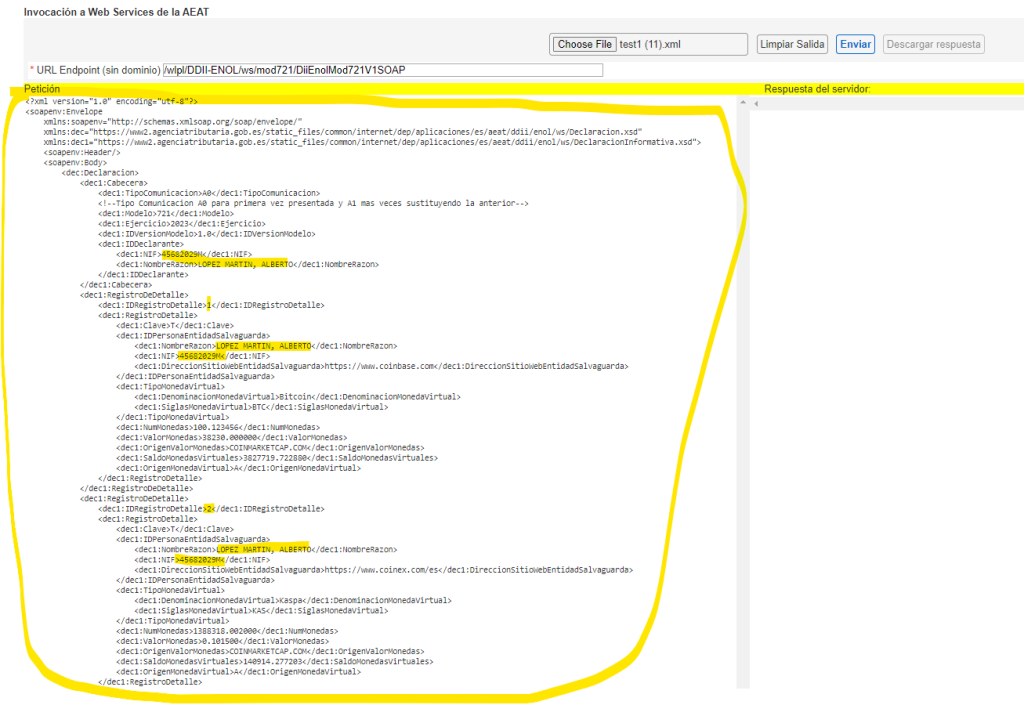

Select the "URL Endpoint (without domain)". /wlpl/DDII-ENOL/ws/mod721/DiiEnolMod721V1SOAP . As you can see it has the string "mod721" in that text.

3. Go to "Choose File" and your device's file browser will open.

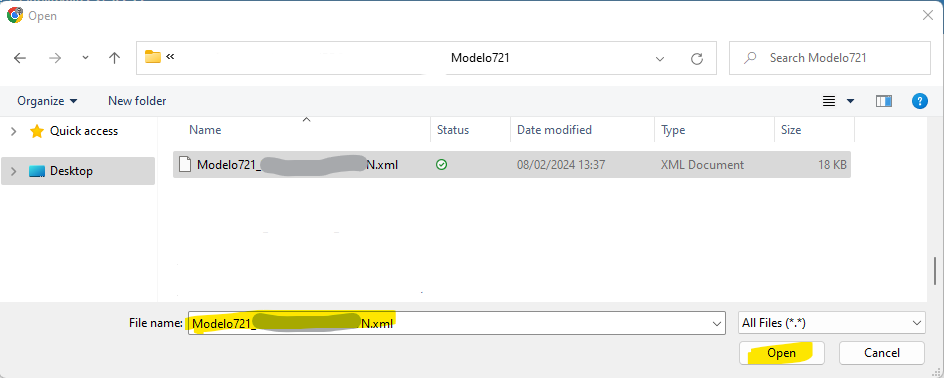

4. Select the XML file you have obtained in your purchase from auto-721.

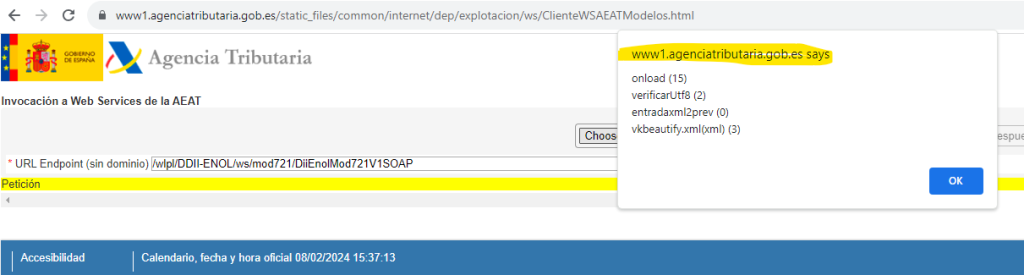

5. The following window will appear, which is correct:

6. You will see the content of your XML on screen, the same as the one you were editing in the "Notepad".

Note: If you want to view the content in Excel format, go to step 8:

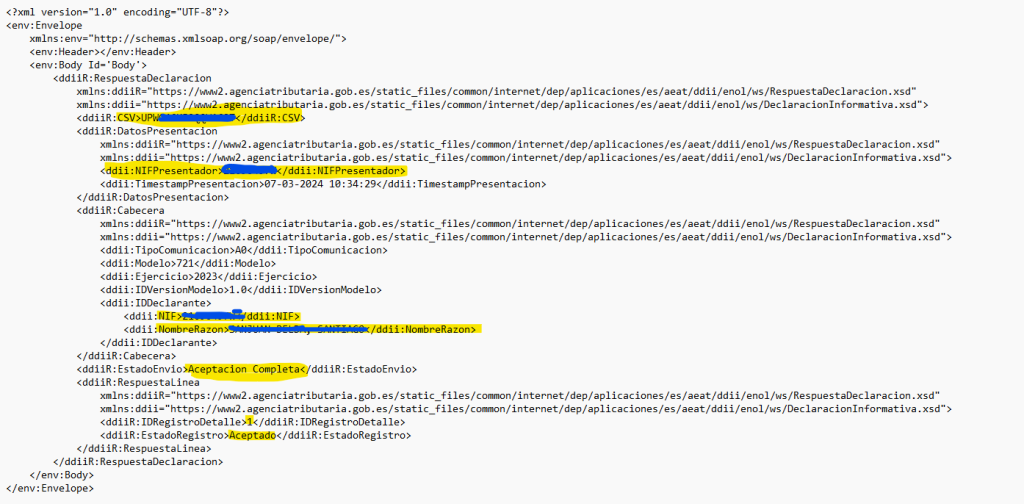

7. If you have reviewed the content of the XML file and are satisfied with it, you can click on the button "send"You will receive a response similar to the one shown below, which you can also download by clicking on the button below. "Download response":

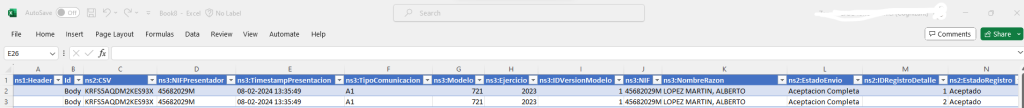

Note: If you want to view the content of the response in an Excel format, copy the entire response into the "Notepad" program and save it with an .XML extension. Then open it in Excel as indicated in step 9.

You have to receive the CSV shipping confirmation and the "Shipment Status"has to indicate "Full Acceptance.

If indicated, "Partial Acceptance then the status of each of the records should be checked to find out the reason for the rejection.

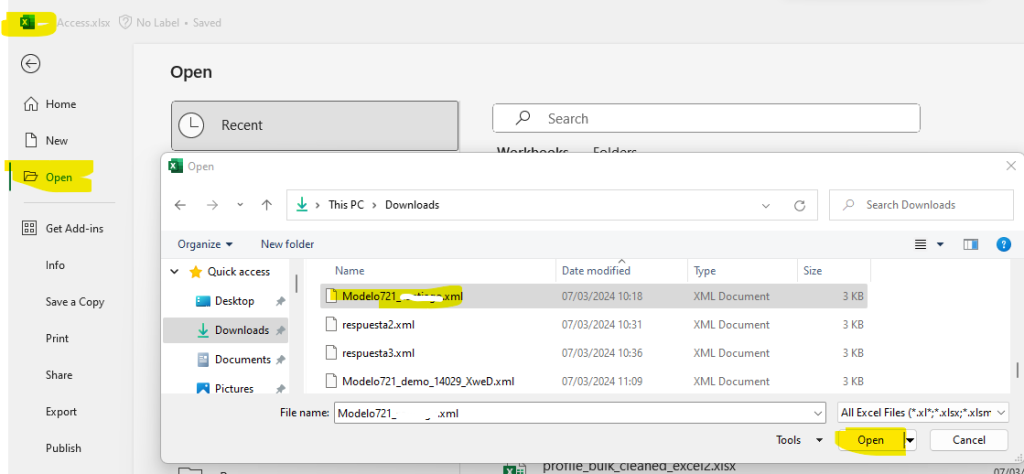

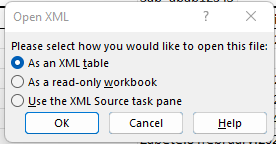

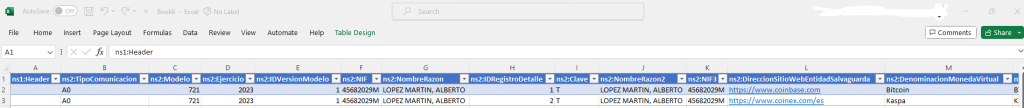

8. Open the excel program, and from there open the XML file that we have uploaded to AEAT.

It will prompt you if you want to display it in 'XML table' format and say yes. It will be displayed as follows:

9. Open the excel program, and from there open the XML file that has been downloaded with the response from the AEAT. You will be asked if you want to show it in 'XML table' format and say yes. It will be displayed as follows:

10. You can also view the submitted declaration at Tax Agency: Form 721. Information return on virtual currencies located abroad.

Diputación Foral de Gipuzkoa instructions form 721

Once you have the Form 721 file generated by Autodeclaro, the DNI that appears in the file is 00000000T.

(TO BE FINALISED)

Provincial Council of Bizkaia

(TO BE FINALISED)

The information page on Form 721 in Bizkaia is: https://www.bizkaia.eus/ogasuna/guregida/fitxabisorea.asp?Tem_Codigo=7884&Idioma=CA&IdPublicoMostrar=1267

However, the way to fill in Form 721 is by means of the programme/software called Bila. You can download it at: https://www.bizkaia.eus/Ogasuna/software/descargar_instalar.asp?Idioma=CA&Tem_Codigo=10260&dpto_biz=5

Provincial Council of Alava

(TO BE FINALISED)

Here you can see the information on Form 721 in the Provincial Council of Álava: https://egoitza.araba.eus/es/-/modelo-721

To file Form 721 with the Provincial Council of Álava, you need the "Programa de ayuda para modelos fiscales", which is software exclusively for Windows. It can be downloaded from here: https://web.araba.eus/es/hacienda/programa-de-ayuda-de-modelos-fiscales

The following are the detailed steps to perform the import of the Model 721 generated by Autodeclaro in the "Programa de ayuda para modelos fiscales" of the Provincial Council of Álava.

Treasury of Navarre

(TO BE FINALISED)

© 2021 AUTODECLARO.ES - All rights reserved

SOFTWARE DEVELOPED IN SPAIN