What's new in Auto-720 for 2025?

For the 2025 campaign, Autodeclaro incorporates new enhancements aimed at reduce time, avoid mistakes and ensure that the completion of the 720 Form is 100 % precise.

Specific new features this year are:

News 2025

- Automatic identification of the amount and date of sale for registrations type C (extinguishment or sale of assets), streamlining the declaration and avoiding manual adjustments.

- IBKR cash statement support, The average balance for the last quarter, The "cash abroad" is compulsory when declaring cash abroad.

Improvements already incorporated in 2024

In addition to the new functionalities, the improvements introduced in the 2024 campaign are maintained:

- Automatic completion of the complete address of the custodian entity for broker-dealer statements.

- Excel summary, which allows you to quickly and visually review the total content of the Form 720 generated.

- Detection of the origin of the type of good (A, M or C) based on previous Model 720 returns.

Full address

Are you still looking for the full address of each company?

We have invested in a data source to obtain the full address of every company listed on the world's stock exchanges. The data provider is called "Financial Modeling Prep.

This helps to ensure that for each position, the full address is automatically entered in the 720 model.

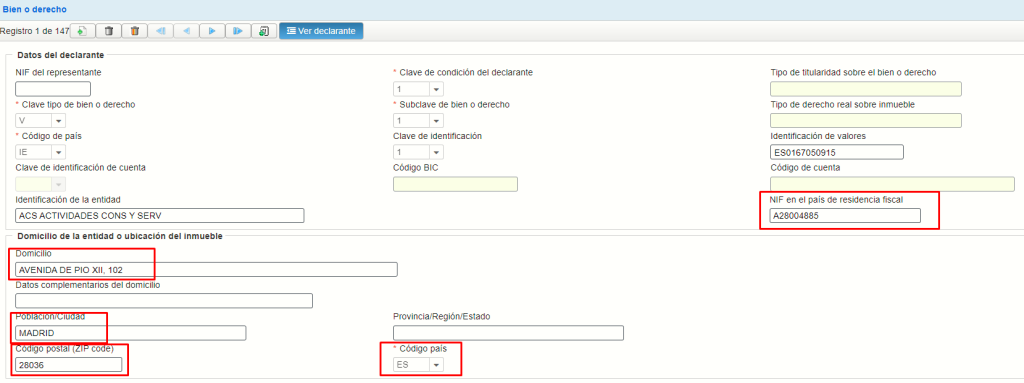

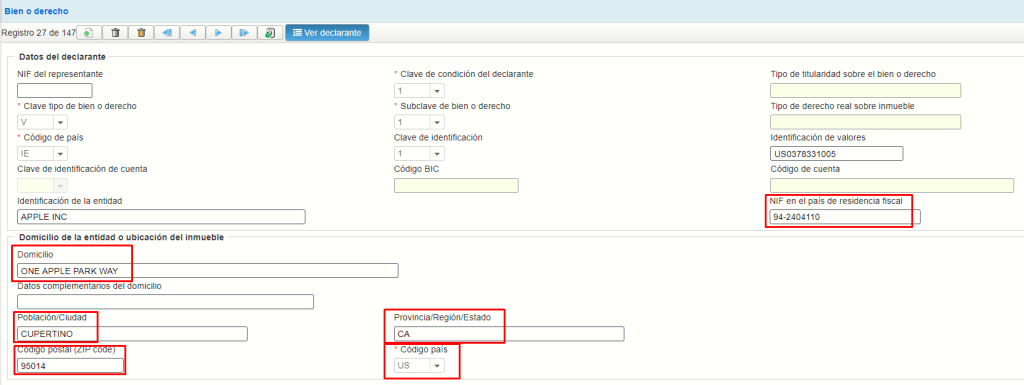

The result would look like this, with the 'TIN in the country of physical residencel', 'Address‘, ‘Population‘, ‘Province‘, ‘Postcode' y 'Country codeThe completed

Example of ACS:

Example from APPLE INC.

100% Accurateis a fully automated process in which there is no human involvement. You can have complete confidence in the result generated and with an accuracy of 100%.

Excel Summary

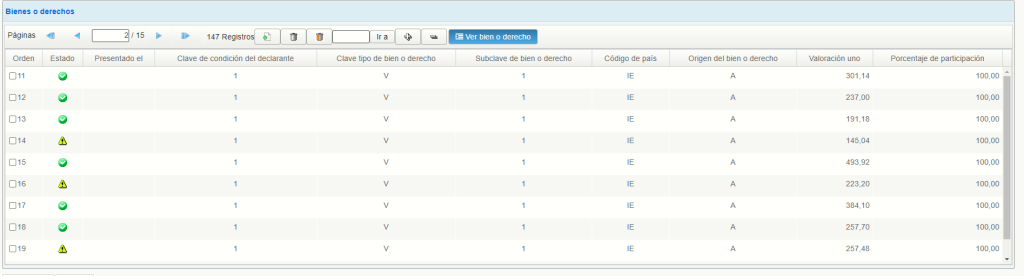

Do you find it too tedious to check the Form 720 filed on the AEAT website or your regional tax office?

Obtain in an excel file all the records that are going to be submitted in your Form 720.

Currently the only way to review your 720 model was to enter it record by record or to view it in groups of 15 records.

Now it will be easier, as you will have it in Excel, where you will be able to filter, add up, etc., whatever you wish to ensure that everything is included in your Form 720.

We will never share or sell the information you provide with third parties. Your anonymity and security is our primary commitment to ensure complete trust and confidence in you.

Origin of the type of good in items already reported in previous years

Note: Only applies to those clients who use brokers to buy and sell securities, such as: stocks, ETFs, bonds, funds, etc..

If you are a customer of Raisin, or you use excel to complete your assets abroad, this functionality does not apply to you.

Do you indicate in detail those purchases or sales in previously declared positions?

To this end, we have created the possibility of completing second and successive Model 720 declarations: Type 1 and Type 2.

NOTE: The choice of Type 1 and Type 2 are equally valid before the Treasury, they simply detail to a greater or lesser extent purchases and sales of positions declared in previous Form 720 filings.

- Type 1Will create a single record with the current quantity of each item: Source field Asset type shall be M (already declared).

- Type 2: It will create two records depending on whether it is a increase or decrease:

IncreaseOne of type origin of good M (already declared) with what was declared the previous year and another record of type origin of good A (new acquisition).

DecreaseOne record of type of origin of asset M (already declared) with what is available at the end of the year and another record of type of origin of asset C (Extinguished asset) with the number of shares sold.

"Origin of the good or rightLet's remember the three possible values it has:

- A - An asset or right that is being declared for the first time.

- M - An asset or right that has already been declared in previous years.

- C -Assets or rights that are declared because ownership is extinguished

That is, this field indicates whether an asset is being declared for the first time (in our first Model 720, all are going to be of type A - declared for the first time), but in second and subsequent filings, declared assets will have the value of M - already declared or if we already have them, they will have value C - title lapsed

Having explained the field "Origin of the good or right", it will help us to explain the improvements we have introduced in Autodeclaro. Let's take an example.

2024 Model 720 Campaign

In that campaign you stated:

- 100 BBVA shares. As it was a new asset declaration, the origin of the type of good would be A

- 50 APPLE shares. Assume that this asset is already declared to you in 2021, the origin of the type of good shall be M

Simple enough, but in the year 2023 the following events occur:

- We sell 50 BBVA shares.

- We acquired 100 APPLE shares.

2025 Model 720 Campaign

Let's see how to indicate this in the 2023 Form 720, because as we saw, we will have two options.

- Type 1Will create a single record with the current quantity of each item: Source field Asset type shall be M (already declared).

- Type 2: It will create two records depending on whether it is a increase or decrease:

IncreaseOne of type origin of good M (already declared) with what was declared the previous year and another record of type origin of good A (new acquisition).

DecreaseOne record of type of origin of asset M (already declared) with what is available at the end of the year and another record of type of origin of asset C (Extinguished asset) with the number of shares sold.

Type 1 - Single record type M

There is not much mystery, let's declare each of the records as type M with the value they will have at the end of the year 2023.

- 50 BBVA shares. We sold 50 of the initial 100, we indicated that we own 50 shares with the origin of the type of good would be M.

- 100 APPLE shares. We buy 50 plus the previous 50, it is indicated that we own 100 shares on origin of the type of good shall be M.

Type 2 - Record type M and types A and C according to whether there have been increases or decreases.

Thus we have the following statement of records.

- 50 BBVA shares. That we already declared in the 2022 financial year the field. origin of the type of good would be M.

- 50 BBVA shares. 50 shares for sale for the financial year 2022, the field origin of the type of good would be C.

- 50 APPLE shares. That we already declared in the financial year 2022 50 previous financial years, the field origin of the type of good shall be M.

- 50 APPLE shares. We buy 50 in the year 2023, so the field origin of the type of good shall be A.

NOTE: The choice of Type 1 and Type 2 are equally valid before the Treasury, they simply detail to a greater or lesser extent purchases and sales of positions declared in previous Form 720 filings.

© 2021 AUTODECLARO.ES - All rights reserved

SOFTWARE DEVELOPED IN SPAIN